(Bloomberg) -- European stocks started the week on a positive note, tracking Friday’s gains on Wall Street and a rally in Asia after China announced support for its equities market.

Most Read from Bloomberg

The Stoxx Europe 600 index climbed about 0.6% at the open. Technology stocks led the advance as traders assessed comments from Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde at Jackson Hole on Friday that didn’t change the outlook for interest rates. Trading volumes in Europe may be subdued throughout the day with UK markets closed for a bank holiday. US equity futures edged higher, while Treasury yields dipped and the dollar was steady.

US stocks rose and Treasury yields jumped on Friday after Powell stuck to the script in his Jackson Hole speech, saying that the Fed is “prepared to raise rates further if appropriate,” even as he stressed that the central bank would “proceed carefully,” guided by economic data. Lagarde, likewise, said the ECB would set borrowing costs as high as needed to keep inflation in check.

“Not much was said that changed our outlook for US equities” after Powell’s comments, RBC Capital Markets strategist Lori Calvasina wrote in a note. “Equity investors have already been wrapping their heads around the idea that rates may be higher for longer, that it’s possible the Fed’s job may not be done just yet, and that they are data dependent. That message seemed reinforced Friday, but we don’t see it at odds with what we’ve been hearing from many equity investors recently.”

Asian benchmarks rose, though Chinese stocks pared most of their early gains on Monday, showing once again that Beijing’s efforts to boost its markets are falling flat in the face of economic worries. Having opened 5.5% higher, the CSI 300 Index of mainland stocks was up about 1.4% at 2:46 p.m. in Shanghai. Foreign funds accelerated their selling through the day, poised to take this month’s outflows to the biggest on record.

Elsewhere, both oil and gold were little changed.

Key events this week:

-

US Conference Board consumer confidence, Tuesday

-

Eurozone economic confidence, consumer confidence, Wednesday

-

US GDP, wholesale inventories, pending home sales, Wednesday

-

China manufacturing PMI, non-manufacturing PMI, Thursday

-

Japan industrial production, retail sales, Thursday

-

Eurozone CPI, unemployment, Thursday

-

ECB publishes account of July monetary policy meeting, Thursday

-

US personal spending and income, initial jobless claims, Thursday

-

China Caixin manufacturing PMI, Friday

-

Eurozone S&P Global Eurozone Manufacturing PMI, Friday

-

South African central bank governor Lesetja Kganyago, Atlanta Fed President Raphael Bostic, BOE’s Huw Pill, IMF’s Gita Gopinath on panel at the South African Reserve Bank conference, Friday

-

Boston Fed President Susan Collins speaks at virtual event, Friday

-

US unemployment, nonfarm payrolls, light vehicle sales, ISM manufacturing, construction spending, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 rose 0.6% as of 8:13 a.m. London time

-

S&P 500 futures rose 0.1%

-

Nasdaq 100 futures were little changed

-

Futures on the Dow Jones Industrial Average rose 0.3%

-

The MSCI Asia Pacific Index rose 1.1%

-

The MSCI Emerging Markets Index rose 0.7%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro rose 0.2% to $1.0817

-

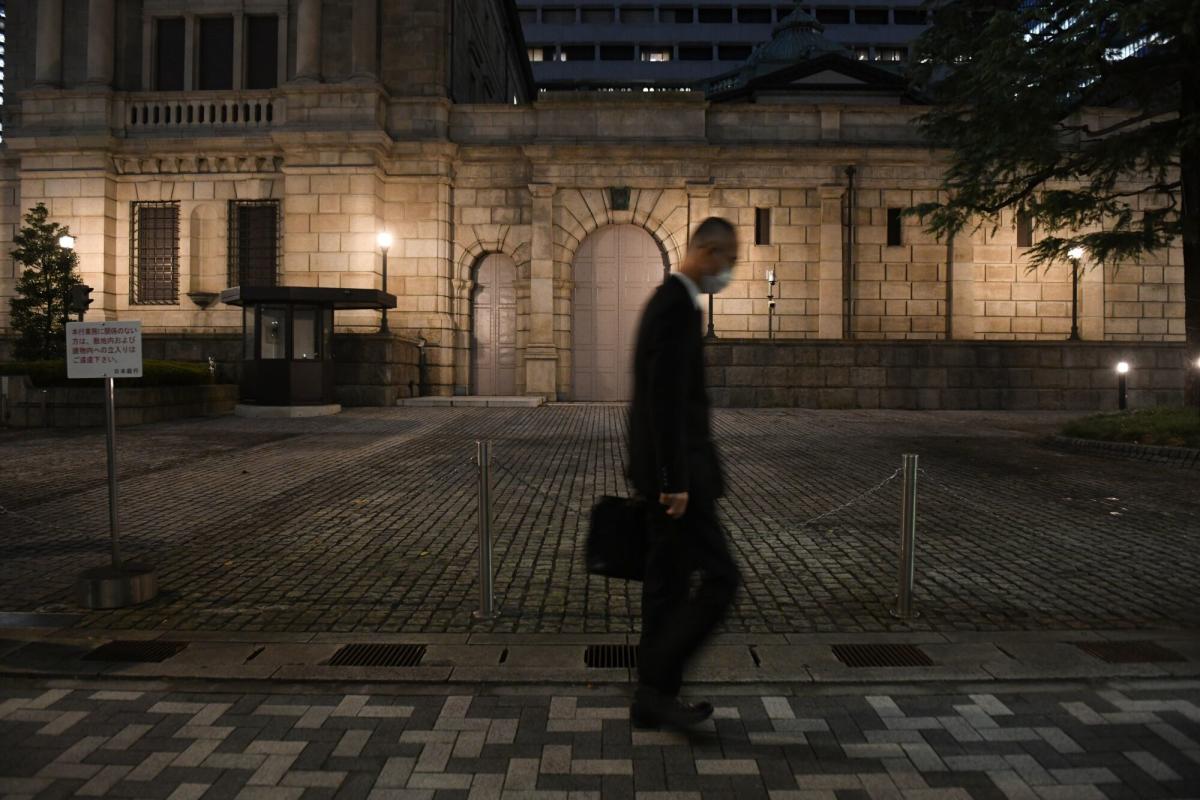

The Japanese yen was little changed at 146.40 per dollar

-

The offshore yuan was little changed at 7.2964 per dollar

-

The British pound rose 0.1% to $1.2593

Cryptocurrencies

-

Bitcoin fell 0.6% to $25,924.85

-

Ether fell 0.7% to $1,641.66

Bonds

-

The yield on 10-year Treasuries declined two basis points to 4.22%

-

Germany’s 10-year yield was little changed at 2.57%

-

Britain’s 10-year yield advanced two basis points to 4.44%

Commodities

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Chester Yung and Farah Elbahrawy.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Article From & Read More ( European Stocks Gain as China Support Lifts Mood: Markets Wrap - Yahoo Finance )https://ift.tt/Csh6lFm

Business

Bagikan Berita Ini

0 Response to "European Stocks Gain as China Support Lifts Mood: Markets Wrap - Yahoo Finance"

Post a Comment